DVC Buybacks in 2025: Breaking Down the Numbers

As of now in 2025, Disney has exercised Right of First Refusal (ROFR) on 15 Disney Vacation Club contracts with The Timeshare Store, Inc.®. Buybacks are always an important factor in the secondary market since they directly impact both buyers and sellers. By comparing buybacks to total sales volume, we get a clearer sense of how aggressively Disney is reclaiming inventory that is being resold this year.

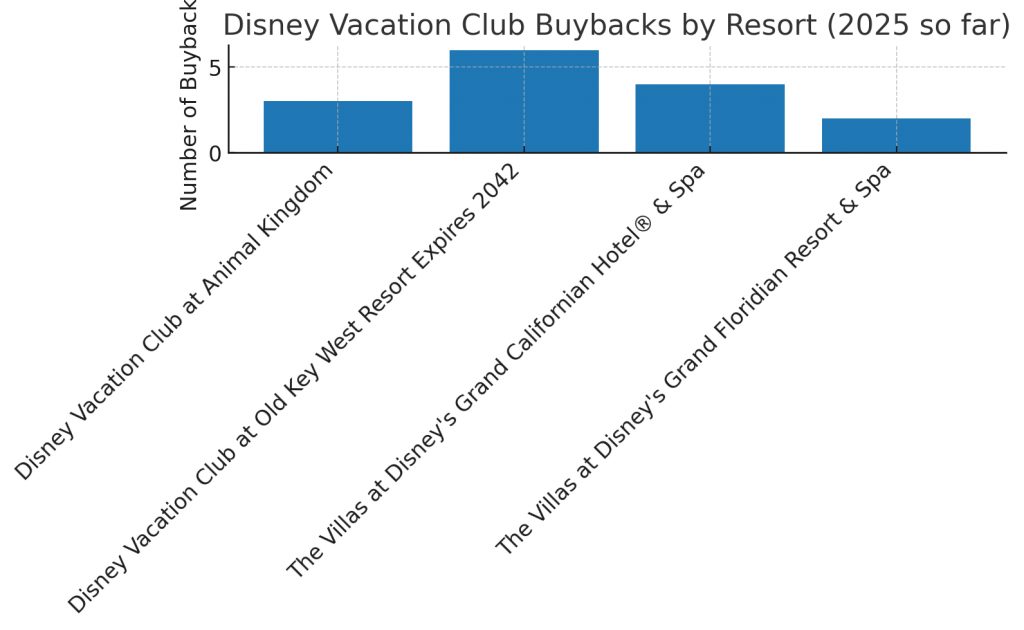

Buybacks by Resort

Here’s how buybacks are distributed across the 17 different DVC resorts thus far:

– Old Key West – 6 buybacks

– Animal Kingdom – 3 buybacks

– Grand Californian – 4 buybacks

– Grand Floridian – 2 buybacks

While Old Key West has the most contracts reacquired thus far in 2025, the smaller sales pool of Grand Californian makes its buyback activity particularly significant.

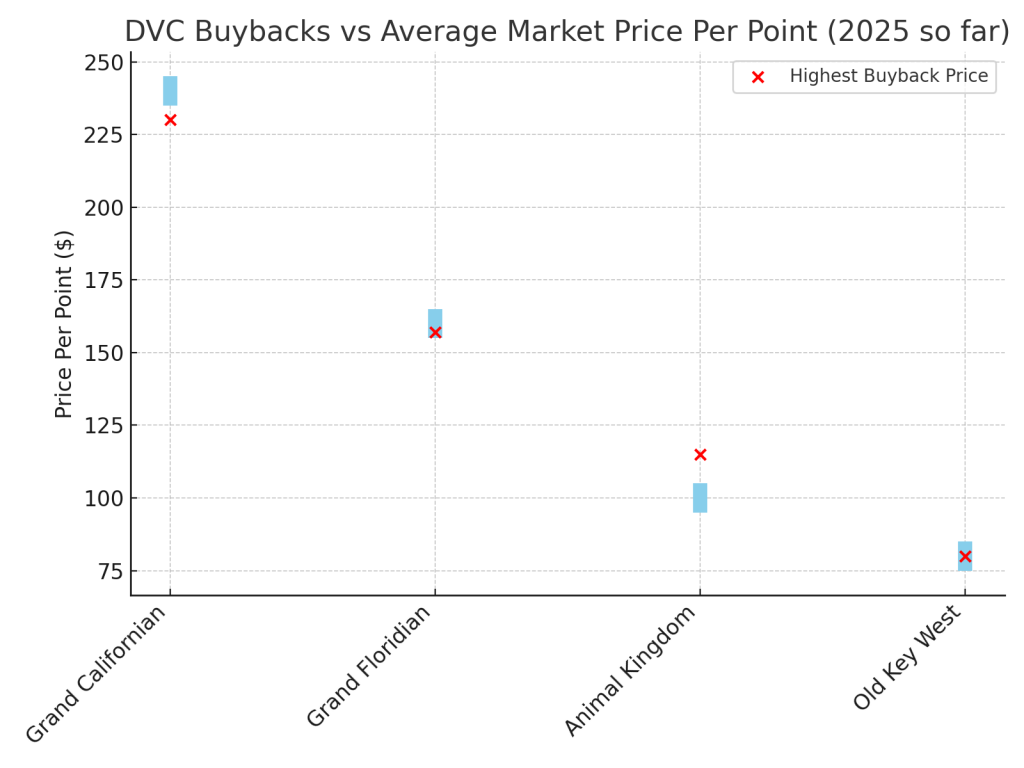

Average Price Per Point on Buybacks

Disney’s willingness to buy back contracts depends heavily on price per point (PPP). There are other factors that come into play but typically the price is the main cause for Disney to buy back a property.

Below are the highest prices we’ve seen this year that Disney paid for a particular DVC location:

– Grand Californian – Highest Price bought back was $230/pt

– Grand Floridian – Highest Price bought back was $157/pt

– Animal Kingdom – Highest Price bought back was $115/pt

– Old Key West – Highest Price bought back was $80/pt

This reinforces the premium value of the Grand Californian and Grand Floridian, while also showing Disney’s appetite for the lower-priced Old Key West.

Grand Cal: Highest buyback at $230/pt vs. market avg $235–$245/pt

Grand Floridian: Highest buyback at $157/pt vs. market avg $155–$165/pt

Animal Kingdom: Highest buyback at $115/pt vs. market avg $100–$110/pt

Old Key West: Highest buyback at $80/pt vs. market avg $78–$85/pt

This chart shows that even though some of the packages will sell within the average market value, there are times Disney will still step in and buy back the property. Typically, when this happens, it increases the resale value of that DVC location to prevent Disney from buying more of that location on future resales. The great thing about Disney acting on their ROFR is it helps retain the resale values for all DVC Members (resale or direct).

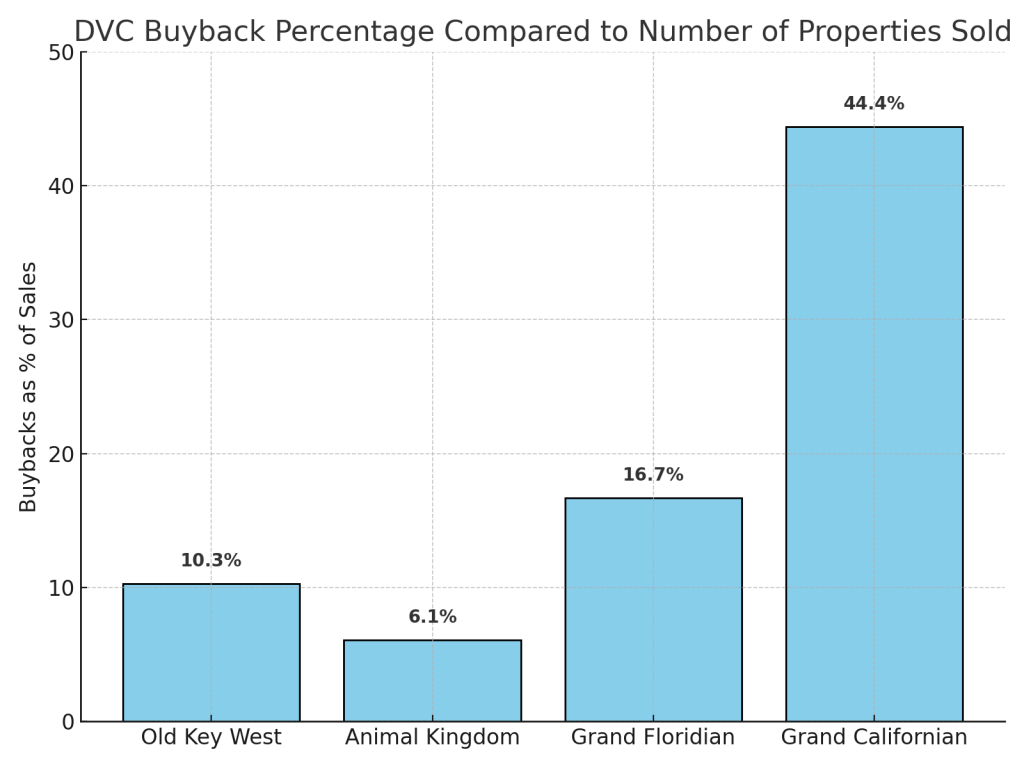

Buybacks Compared to Total Sales per location

Looking at total sales helps put the buybacks into perspective:

– Old Key West: 58 sales → 6 buybacks (~10%)

– Animal Kingdom: 49 sales → 3 buybacks (~6%)

– Grand Floridian: 12 sales → 2 buybacks (~17%)

– Grand Californian: 9 sales → 4 buybacks (~44%)

These are the only four DVC locations that Disney bought back from The Timeshare Store,Inc.® in 2025 (so far). The other 14 DVC resorts had zero buybacks as of the time of writing this article.

The DVC Resorts with NO Buybacks

The resorts with no buybacks for 2025 are: Aulani, BoardWalk, Beach Club, Bay Lake Tower, Boulder Ridge, Copper Creek, Riviera Resort, Villas at Disneyland Hotel, Cabins at Fort Wilderness, Polynesian, Vero Beach, Hilton Head, and Saratoga Springs. If you are considering purchasing one of these DVC locations, you should not have any issue passing right of first refusal at this time.

Disney has only bought back 3.93% in 2025

Of all the sales The Timeshare Store, Inc.® has done in 2025, Disney, on average, has only bought back 3.93% of our sales. This % is less than the average 6.02% per year over the past 30+ years we’ve been in business (since 1994).

Some brokers see a higher percentage of Disney buybacks than The Timeshare Store, Inc.® because they promote what’s known as an “Instant Sale”. This option is designed to help a seller move their contract quickly, but it often involves pricing the contract well below typical resale value. When that happens, Disney is much more likely to exercise its Right of First Refusal (ROFR) and buy the property back.

For the broker, it’s straightforward—they still receive their commission whether the buyer or Disney completes the purchase. For the seller, the main advantage is speed: the contract sells right away. The trade-off, however, is that the seller receives less than the contract might bring on the open market.

It’s important to note that while some online discussions suggest Disney’s ROFR is “in full effect,” the data shows otherwise. Statistically, about 96% of contracts pass through ROFR without being bought back through The Timeshare Store, Inc.® This means the majority of sellers are able to list their contracts at fair market value and complete the sale successfully. In these cases, both parties benefit—the seller receives a fair price for their contract, and the buyer secures their purchase and typically clears ROFR without issue. Win-Win!!

What This Means for Buyers & Sellers

– For Buyers: Be aware that Disney is most aggressive at the Grand Californian and Grand Floridian. Offers at these resorts—especially below average market pricing—are more likely to be bought back.

– For Sellers: Disney’s buybacks can signal strong demand and favorable pricing. At Old Key West and Animal Kingdom, while buybacks are happening, buyers are still getting many contracts through ROFR. ✅ Bottom Line: As of 2025, Disney has reacquired 15 contracts through ROFR. While Old Key West dominates in raw sales, Grand Californian stands out with the highest buyback rate, making it the resort most closely watched by Disney.

Written By:

Who is Jerry Sydow? When it comes to creating magic and maximizing value on a Disney Vacation or DVC Membership, Jerry is the trusted expert. He doesn’t just sell Disney Vacation Club—he lives and breathes the Disney brand. With unmatched knowledge and a passion for helping families experience the magic, he never misses a detail.

With over 25 years at The Timeshare Store, Inc.®, Jerry has sold more than 8,000 Disney Vacation Club memberships. Whether you’re looking to join DVC or find the perfect DVC rental, Jerry and his team are here to make the experience seamless, magical, and memorable.